Accountants for Streamers

Even in the dynamic realm of streaming, having an accountant by your side can be a complete game-changer. Capture Accounting can help to free up your time and help you keep more of your earnings.

Are you a passionate streamer diving headfirst into the exhilarating world of content creation? As you immerse yourself in building your online presence and engaging with your dedicated audience, there's one crucial aspect you can't afford to overlook – your financial well-being.

Managing your accounts may seem a time-consuming chore, but it's essential to help reach financial goals faster, manage expenses, invest in the future, and be prepared for financial emergencies.

If you are struggling to keep a handle on your accounts, Capture Accounting has got your back. We can help you achieve greater financial stability and security to give you valuable peace of mind. That way, you'll have the freedom and flexibility to pursue your aspirations and passion for streaming.

Welcome to Capture Accounting, specialist accountants for streamers and gamers

Accountants for Streamers

What is a streamer?

We consider a streamer a digital entrepreneur who creates and broadcasts live video content over the internet, typically through platforms like Twitch, YouTube, or other streaming platforms.

There are various income streams open to successful streamers, such as ad revenue and sponsorships. When you start to generate income in this way, you are considered to be running your own business, so it's a smart move to work with an accountant to manage and record your taxable income properly.

Why does a Streamer need an accountant?

There are lots of good reasons to work with an accountant; here are our top 5.

Compliance: Once you start to earn income from your streaming activities, you must register with HMRC and complete an annual tax return. Once your income exceeds the tax-free personal allowance, then you must start to pay tax. Tax law is complex and ever-changing. An experienced accountant will be up-to-date with the latest tax regulations and ensure you understand your tax liabilities. They will handle the preparation and filing of your tax returns to avoid penalties or fines.

Optimise tax efficiency: You can deduct allowable expenses from your earnings in order to reduce your tax bill. An accountant can help you navigate what is and is not an allowable expense and ensure that you take full advantage of other tax-saving opportunities to keep more money in your pocket.

Manage multiple income streams: As a streamer, your income often comes from various sources, such as ad revenue and sponsorships. An accountant will help you streamline and organise your financial records, ensuring accurate tracking of each income stream. Not only will this help with your tax return, but it will also help you to nail your monetisation strategy.

Financial planning and growth: An accountant can help you define - and meet - a set of financial goals with effective budgeting and cash flow management. That way, you can build your business and be in the best position to take advantage of new opportunities.

Time and stress management: As a streamer, your time is best spent creating content and engaging with your audience. With an accountant managing your finances, you'll have more time on your hands to do what you love, which will do wonders for your well-being.

Our accounting services for streamers

Some of the key accounting services we offer at Capture Accounting for streamers include:

Bookkeeping

Keeping track of your income and costs is crucial for managing your cash flow. We can take this frankly mundane task away from you. You just need to scan your receipts and invoices using an app, and we'll do the rest.

Tax and VAT

We’ll help you prepare and file your self-assessment tax returns (or Corporation Tax return), and ensure that you are claiming expenses correctly to reduce your bill and keep more money in your pocket.

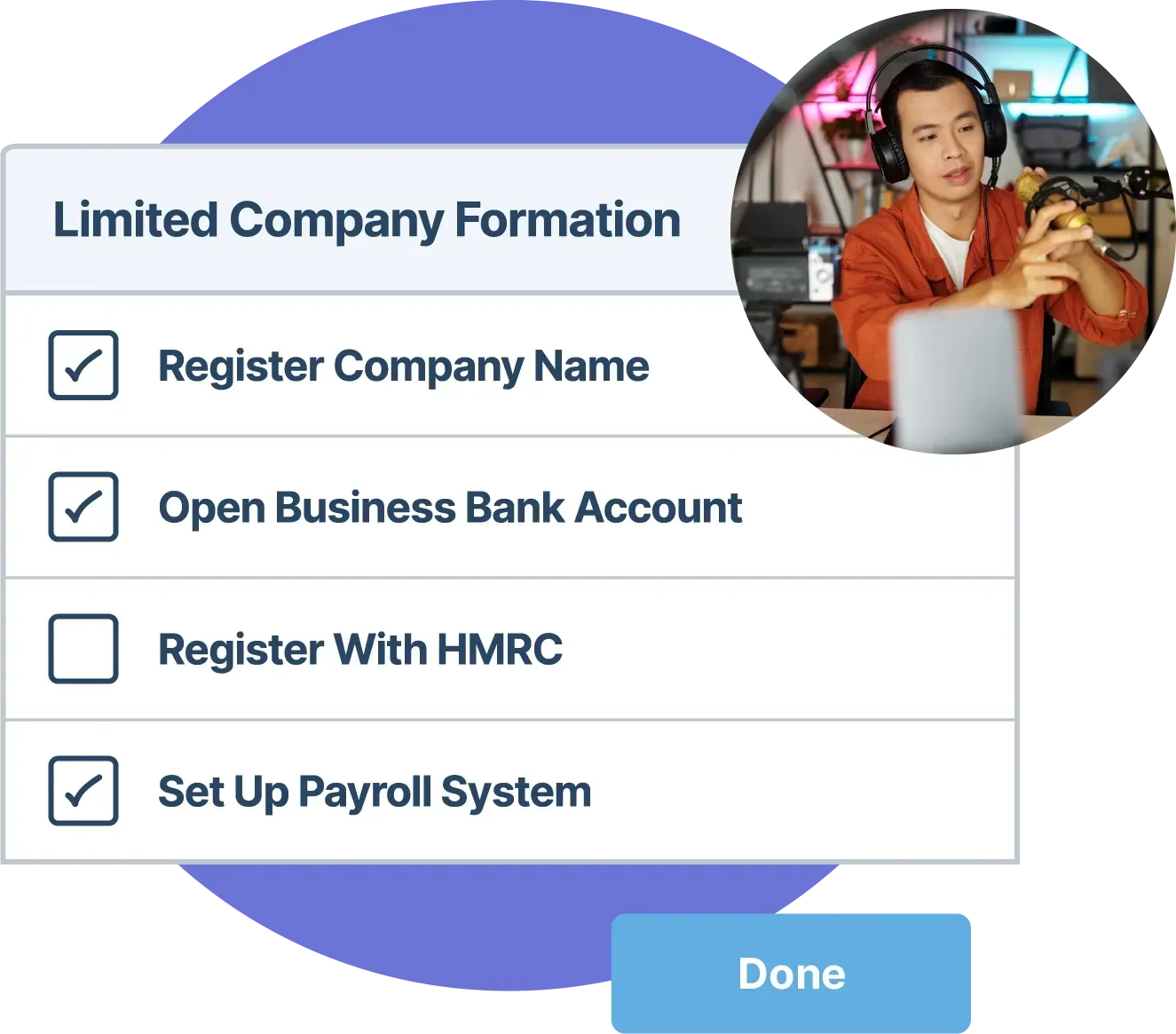

Company formation

If you're considering operating as a limited company, our team can assist you with the company formation process. We'll help you navigate the legal requirements and set up the most suitable structure for your gaming activities.

What to expect from working with us

Industry Expertise

We have extensive experience in working with streamers, YouTubers and social media influencers and understand the unique challenges of this fast-paced world.

Time-saving

You can save valuable time and reduce the stress associated with managing your finances.

Comprehensive Services

From bookkeeping to tax planning and company formation, we offer a wide range of accountancy services designed specifically for YouTubers and content creators.

Tax Efficiency

Our goal is to ensure you make the most of the tax savings available to you so you keep more of your earnings.

Why choose Capture Accounting?

If you are looking for an accountant who can help you with your streaming business, look no further than Capture Accounting. Not only are we specialist accountants for influencers and content creators, but our founder is also a content creator and regularly puts out video content across Linkedin, YouTube and Instagram.

That means we understand first-hand what your biggest challenges are and are well-positioned to help navigate the accounts and tax minefield and help you keep more of what you earn!

We are more than just an accounting firm - we can be a key player in your success story. We are passionate about helping streamers like yourself achieve their financial goals and dreams.

Let us handle the accounting complexities while you concentrate on creating captivating content and growing your influence.

Contact us today for a free consultation and quote.